MIDREX® Direct Reduction Plants 2023 OPERATIONS SUMMARY

MIDREX® Plants produced 76 million metric tons (Mt) of direct reduced iron (DRI) in 2023, which is 3.3% more than the 73.56 Mt produced in 2022.

The production total for 2023 was calculated from the 41.64 Mt confirmed by MIDREX Plants located outside of Iran and Russia (LGOK) and the estimated 34.36 Mt for MIDREX Plants in Iran and Russia (LGOK), which is based on data reported by the World Steel Association (WSA). Over 11 Mt of hot DRI (HDRI) were produced by MIDREX Plants, which were consumed in nearby steel shops to assist in reducing energy consumption per ton of steel produced and to increase productivity.

MIDREX Plants have produced a cumulative total of more than 1.39 billion tons of all forms of DRI (cold DRI, CDRI; hot DRI, HDRI; and hot briquetted iron, HBI) through the end of 2023.

MIDREX Technology continued to account for ~80% of worldwide production of DRI by shaft furnaces in 2023. At least nine MIDREX Modules* established new annual production records and at least nine established new monthly production records. Eleven additional modules came within 10% of their record annual production and 17 operated more than 8000 hours.

The Venezuelan plants (COMSIGUA, Ferrominera Orinoco, Sidor, and Venprecar) operated during 2023 at reduced capacities, but most of their production details were not available. No detailed production information has been received from the plants in Iran and LGOK from Russia. The following plants did not operate in 2023 due to commercial or market conditions: ArcelorMittal Point Lisas in Trinidad, ArcelorMittal South Africa, Delta Steel in Nigeria, ESISCO in Egypt, Lion DRI in Malaysia, and NSCL National Steel Complex Ltd (formerly Tuwairqi Steel Mills) in Pakistan.

* A MIDREX Plant can include one or more modules

2023 PLANT HIGHLIGHTS

ALGERIAN QATARI STEEL (AQS)

In its second full year of operation, after starting up in March 2021 during the pandemic, AQS continued ramping up production to meet its steel shop’s requirements. AQS set new annual production, electricity consumption, and operational time records in 2023, as well as a new monthly production record in December.

Algerian Qatari Steel (AQS)

ANTARA STEEL MILLS

The first MIDREX HBI Module that started up in August 1984 operated 9% over its annual rated capacity. Total iron in its HBI was the highest of all MIDREX Plants, averaging 92.63% for the year. All production was shipped by water to third parties.

Antara Steel Mills

ARCELORMITTAL ACINDAR

In its 45th year of operation, the AM ACINDAR module operated the whole year below maximum capacity due to local market conditions in Argentina. AM ACINDAR has achieved the most production from a 5.5-meter MIDREX Shaft Furnace to date, with over 34 Mt of CDRI produced. AM ACINDAR set a new annual metallization record in 2023.

ArcelorMittal Acindar

ARCELORMITTAL CANADA

In its 50th anniversary year, Module 1 operated a record 8542 hours, with a 99.6% plant availability. Module 2 surpassed the 30-Mt mark since start of production and operated with a 99.4% plant availability in 2023. The Module 2 average DRI total iron percentage for the year was the second highest of all MIDREX Plants at 92.04%.

ArcelorMittal Canada

ARCELORMITTAL HAMBURG

The longest-serving MIDREX Module operated at reduced capacity during the warmer months of the year due to the limited natural gas (NG) availability and high NG prices in Europe and remained shut down during the colder months of the year.

ArcelorMittal Hamburg

ARCELORMITTAL LÁZARO CARDENAS

AMLC produced 24% over its annual rated capacity of 1.2 Mt using almost exclusively oxide pellets made in its adjacent pellet plant. Its 6.5-meter reduction furnace has produced a total of 39.0 Mt of CDRI, the most by a single module to date.

ArcelorMittal Lazaro Cardenas

ARCELORMITTAL POINT LISAS

All three MIDREX Modules remained shut down throughout the year.

ARCELORMITTAL SOUTH AFRICA

(SALDANHA WORKS)

This COREX® export gas-based MxCol® Plant was idled in January 2020 and remained shut down throughout 2023.

ARCELORMITTAL TEXAS HBI

The ArcelorMittal Texas 2.0 Mt/y HBI module located near Corpus Christi, Texas, USA, established new annual production, NG and electricity consumption, and operational time records in 2023, as well as a new monthly production record in May. In July 2022, ArcelorMittal completed the acquisition of an 80% stake in the HBI plant from voestalpine AG (Austria).

ArcelorMittal Texas HBI

ARCELORMITTAL/NIPPON STEEL INDIA

All six modules combined have produced over 91 Mt of HDRI, HBI, and CDRI since start-up of the first two modules in 1990. All modules combined fell 0.4% short of equaling their multi-module production record established in 2021. AM/NS India’s Modules I, III, V, and VI operated above rated capacity and Modules III and VI surpassed the 15-Mt milestone. Approximately 96% of the output from the four HDRI/HBI modules was in the form of HDRI. Modules I and VI produce CDRI exclusively. Modules V and VI operated using top gas fuel-to-VPSA for CO2 removal, and COREX gas was used to fuel the reformer burners. COREX gas represented 19-22% of the energy input. Mod IV established new annual productivity and electricity consumption records in 2023, as well as a new monthly production record in May. Modules V and VI operated over 8000 hours. Mod V established a new annual operational time record in 2023. Module VI established new annual production and productivity records in 2023, as well as a new monthly production record in June.

ArcelorMittal/Nippon Steel India

CLEVELAND-CLIFFS

In its third full year of operation, Cliffs operated 6% over its annual rated capacity and produced just 0.3% less than its annual production record set in 2022. Cliffs set new annual productivity, NG, and electricity consumption records in 2023, as well as a new monthly production record in August. The 1.6 Mt/y plant located in Toledo, Ohio, USA, produces HBI, mainly for consumption by internal Cleveland-Cliffs steel companies in the region.

Cleveland-Cliffs

COMSIGUA

In their 25th anniversary year, COMSIGUA’s production of HBI fell to an all-time low of ~35,000 metric tons (t), distributed over 5 months of the year.

DELTA STEEL

The two modules in Nigeria did not operate in 2023.

DRIC

Both of DRIC’s modules in Dammam, Saudi Arabia, operated well above rated capacity and set a new combined module annual production record of 1.19 Mt. Module 1 set new annual production, productivity, and electricity consumption records in 2023, and broke monthly production records twice in 2023. Module 2 set a new annual electricity consumption record in 2023.

DRIC

ESISCO

After shutting down in early March of 2020, Beshay Steel’s MIDREX Plant remained shut down throughout 2023.

EZDK

Production was above rated capacity in all three modules, and with over 3 Mt of total production, the three modules exceeded their multi-module production record set in 2004. Module 1 surpassed the 30-Mt milestone and the three modules combined have produced over 74 Mt to date. Modules 1 and 2 set new annual electricity consumption records in 2023. Module 2 set a new annual production and productivity record in 2023.

EZDK

FERROMINERA ORINOCO

Ferrominera Orinoco’s HBI module in Puerto Ordaz, Venezuela, is reported to have produced small amounts of HBI (not exceeding 20,000 t per month) over a 6-month period for a total production of ~62,000 t in the year.

HADEED

In the 40th anniversary year from the start-up of Module A, the four MIDREX Modules at Hadeed in Saudi Arabia, surpassed the 109-Mt production milestone in 2023, and were within 2.4% of their total, multi-module annual production record set in 2013. Modules A and B were shut down for major maintenance in the months of May and June. Module B averaged 2.64% carbon in its DRI for the year, which was the second highest of all MIDREX Plants. Module B surpassed the 25-Mt mark, and Module C operated over 8200 hours to surpass the 30-Mt production milestone in 2023. Module E set a new annual operational time record in 2023 and was within 0.5% of its annual production record. With over 27.5 Mt produced to date, Module E has attained the most production from a 7.0-meter MIDREX Shaft Furnace. Hadeed also owns an HYL plant (Module D).

Hadeed Module E

JINDAL SHADEED

After establishing a new annual production record of 1.82 Mt in 2022, Jindal Shadeed’s HOTLINK® Plant operated over its rated capacity of 1.5 Mt in 2023 and surpassed the 20-Mt milestone. Thanks to added HDRI bin capacity at the MIDREX Plant, 98.3% of production was consumed as HDRI in the steel shop that is physically attached to the DR Plant. The single module plant, located in Sohar, Oman, is designed to produce mostly HDRI, with HBI as a secondary product stream.

Jindal Shadeed

JSPL (ANGUL)

This is the first MxCol Plant using synthesis gas from coal gasifiers to produce both HDRI and CDRI for the adjacent steel shop. HDRI production was 54% of total production. Coke oven gas (COG) use in the DR plant continued throughout the year, averaging ~15% of the plant’s energy requirements.

JSPL (Angul)

JSW STEEL (DOLVI)

JSW Steel’s module producing CDRI handily exceeded its rated capacity and operated 8198 hours. Approximately 10% of the plant’s energy input is COG injected to the shaft furnace to reduce NG consumption. JSW Steel (Dolvi) has averaged 8044 hours of operation per year since its initial start-up in 1994, and 8149 hours per year in the last 8 years.

JSW Steel (Dolvi)

JSW STEEL (TORANAGALLU)

JSW Steel’s HDRI/CDRI module in Toranagallu, Karnataka State, India, using COREX export gas as energy input, operated over 8000 hours and increased its production compared to 2022, although limited by the availability of COREX export gas. Fifty five percent of production went to the steel shop as HDRI, with the balance being CDRI. This is the second plant of its kind, the first being ArcelorMittal’s COREX/MIDREX plant at Saldanha, South Africa, which is presently shut down.

JSW Steel (Toranagallu)

LEBEDINSKY GOK

The production for 2023 was estimated, based on data for Russia reported by the World Steel Association (WSA) and the annual average from 2019-2022.

LGOK HBI-2

LION DRI

The Lion DRI module, located near Kuala Lumpur, Malaysia, remained shut down throughout 2023 due to competition from foreign steel products.

LGOK HBI-3

LISCO

Production by LISCO’s two DRI modules and one HBI module in Misurata, Libya, showed a marked improvement in 2023 compared to previous years. Module 3, producing HBI mainly for export, ramped up production to 7.8% overrated capacity. Module 3 set new annual production and electricity consumption records and a new monthly production record in October. Modules 1 and 2 also ramped up production of CDRI to feed the LISCO steel shop. The three modules combined surpassed the 35-Mt milestone and set a new multi-module production record that was standing since 2005.

LISCO

NSCL (FORMERLY TUWAIRQI STEEL MILLS, LTD)

The 1.28 Mt/y combination plant, located near Karachi, Pakistan, did not operate in 2023 due to market conditions, 10 years after initial plant start-up. Ciena Group acquired the plant in April 2022, renaming it National Steel Complex Limited (NSCL).

NU-IRON

Nucor’s module in Trinidad and Tobago reported a production of 1.4 Mt of CDRI in 2023, despite a shutdown for routine major maintenance in September and October and downtime caused mainly by outside sources. Average DRI metallization and carbon for the year was the highest of all MIDREX Plants at over 96.2% and 2.72%, respectively.

Nu-Iron Unlimited

OEMK

In the 40th anniversary year from the start-up of Module I, the four MIDREX Modules in Stary Oskol, Russia, surpassed the 85-Mt production milestone in 2023. Module I set new annual production, productivity, and electricity consumption records in 2023, as well as a new monthly production record in July. Module II set new annual productivity and electricity consumption records in 2023 and broke its monthly production record twice in 2023. Module IV surpassed the 20-Mt milestone, as well set new annual production and electricity consumption records in 2023.

OEMK

QATAR STEEL

In its 45th anniversary year, Module 1 remained shut down most of the year due to limited market demand. Module 2 operated 8048 hours in the year and produced over its annual rated capacity, supplying the adjacent steel mill in addition to producing over 500,000 t of CDRI and HBI for export. The complex surpassed the 50-Mt milestone in February 2023. Qatar Steel’s Module 1 has produced over 28.3 Mt of DRI since its start-up in 1978, the most for a 5.0-meter shaft furnace.

Qatar Steel Module 2

SIDOR

Only Sidor’s Module 2B has been reported to have produced DRI in 2023. The other three modules remained shut down.

SULB

In its 10th anniversary year, SULB’s 1.5 Mt/y combination plant (simultaneous HDRI/CDRI production) in Bahrain broke its previous annual production record established in 2018. SULB also set a new annual operational time record in 2023, with 8468 hours. Of the total production, 83% was consumed by the adjacent steel shop as HDRI (98.5% of the DRI received by the steel shop) and 93% of more than 250,000 t of CDRI produced was exported by sea.

SULB

TENARISSIDERCA

TenarisSiderca’s CDRI module in Argentina operated the entire year to satisfy the DRI demand from its steel shop, with the customary shutdown in the cold months of June, July, and August due to NG price. The module’s average DRI metallization percentage for the year was the second highest of all MIDREX Plants at 95.37%.

TenarisSiderca

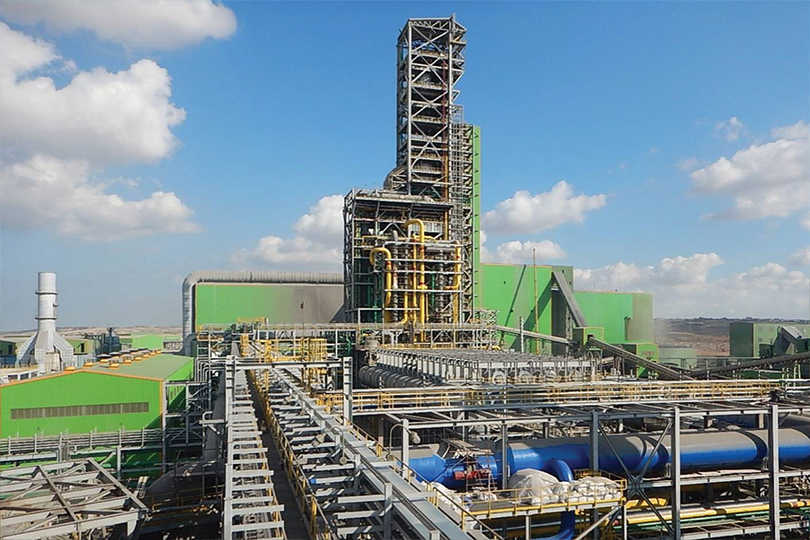

TOSYALI ALGERIE

In its 5th anniversary year, Tosyali Holding’s 2.5 Mt/year combination HDRI/CDRI module, located in Bethioua, near Oran, Algeria, produced just 0.4% less than its annual production record set in 2021, and surpassed the 10-Mt milestone since start-up in 2018. Tosyali has achieved the most production from a 7.5-meter MIDREX Shaft Furnace to date and set a new annual electricity consumption record in 2023. Over 76% of production went to the adjacent steel shop as HDRI. Together with Algerian Qatari Steel (AQS), this is the largest capacity MIDREX Module built to date.

Tosyali Algérie

VENPRECAR

VENPRECAR operated at minimum capacity as best possible due to a lack of raw materials and NG shutoffs.