Increasing HBI Capacity for the Merchant Market

As steel production expands to more and more countries and environmental awareness increases worldwide, the challenge to remain competitive will intensify. Securing the quality and quantity of metallics required for operations within stricter emissions guidelines will be essential.

Natural gas-based direct reduction ironmaking has played an integral role in the industrialization of emerging economies, teaming with the electric arc furnace (EAF) to create national steel industries that could not support the traditional integrated route. The versatility of direct reduced iron (DRI) has allowed the EAF to make any grade of steel products – from reinforcing bars and billets to exposed auto body sheet and has provided steel producers the ability to respond to and take advantage of changing market conditions.

However, not all steel mills included EAFs or were located with a direct reduction plant nearby. Therefore, a form of DRI was needed that could be easily and safely shipped in ocean-going vessels, stored and charged similar to other conventional metallics and possessed sufficient mass and density to effectively penetrate the EAF slag layer or withstand the pressure of the blast furnace (BF). Thus, hot briquetted iron (HBI) was introduced.

Hot briquetted iron (HBI) has been around for decades; however, its true impact has yet to be fully realized by the steel industry. The environmental and productivity gains for integrated steel production coupled with HBI’s well documented handling, shipping and storing benefits will result in greater demand for HBI over the next few decades. In fact, including HBI in the blast furnace (BF) charge may be the best chance to keep some integrated steel works in operation for years to come, as its collective benefits lead to greater furnace productivity and reduced CO2 emissions.

STEEL INDUSTRY EMISSIONS CONSIDERATIONS

In December 2015, China had its first ever red alert for air pollution in Beijing. A red alert is issued when the air quality index is above 300 for three consecutive days (“Heavily Polluted”) that is on a scale that tops out at 500 (“Severely Polluted”). During the red alert, PM2.5 (fine particulate measured in micrometers) was 10 times the recommended level. Within days, India experienced a similar situation. Last year the World Health Organization named India as the country having the worst air pollution on the planet. As a result, Delhi has restricted the use of cars to alternating days and is closing a coal-fired power plant. These incidents have caused the media and governments to focus even more on industry emissions. This focus has goes beyond the scope of particulates and has directly shone a light upon greenhouse gases.

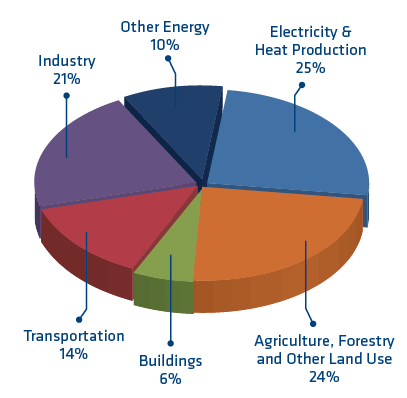

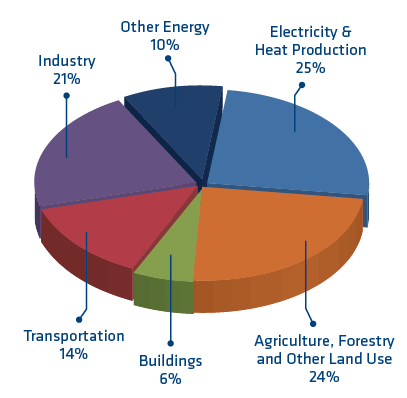

According to a 2014 report by the Intergovernmental Panel on Climate Change (IPCC), carbon dioxide (CO2) makes up 76% of global greenhouse gas (GHG) emissions – 65% from fossil fuel and industrial processes and 11% from forestry and other land uses (Figure 1). Industry accounts for more than 20% of GHG emissions by economic sector and ironmaking alone comprises more than one-fourth of industrial source CO2 (Figure 2). The reason for such a high percentage is that the majority of iron produced in the world is made using fuels that are carbon-based and thus generate significant amounts of CO2 as a by-product.

Total production of CO2 by human activities is currently around 35 billion tons per year. Iron and steelmaking account for almost 7% of mankind’s entire carbon footprint. Ironmaking alone constitutes 80-85% of iron and steel’s total CO2 output. Integrated mills are the largest contributor of CO2 by both volume and percentage, with coke-fueled blast furnaces currently producing well over 90% of the world’s iron.

A PRACTICAL WAY TO KEEP BFS OPERATING

Based on the world steel industry’s coal consumption, it is estimated that BF ironmaking including the processing step to make the coke from metallurgical coal generates approximately 1.8 tons of CO2 for every ton of iron produced. As no proven carbon capture system exists for blast furnaces, the best, although totally impractical way for integrated steelmakers to reduce CO2 emissions is simply by not creating the emissions in the first place. A practical way to keep BFs operating is to take advantage of the benefits of direct reduction ironmaking.

Natural gas-based DRI plants produce 1/3rd the amount of CO2 as BF iron production per ton of product. Even more striking is that the natural gas-based DR plant/EAF steelmaking route produces ½ or less CO2 as the BF/BOF route per ton of product.

Feeding HBI to the BF will reduce an integrated mill’s carbon footprint by decreasing the coke required and increasing productivity. The rule of thumb is for each 10% increase in burden metallization there is an 8% production boost, and the coke rate is reduced by 7%. A reduction of the coke rate will result in significantly lower CO2 emissions.

FIGURE 1.

Global greenhouse gas (GHG) emissions by gas (Source: Intergovernmental Panel on Climate Change, 2014)

FIGURE 2.

Global greenhouse gas (GHG) emissions by economic sector (Source: Intergovernmental Panel on Climate Change, 2014)

SOURCING HBI

If we accept that the most effective, currently available means of lowering the amount of CO2 generated by the steel industry is to use HBI produced by a natural gas-based direct reduction plant in the blast furnace, the important question becomes: “How does a mill sources HBI?”

HBI can be sourced two ways by an integrated steel mill:

- Buy HBI from a dedicated merchant HBI plant or from a DRI plant with the capability to produce HBI; or

- Build a natural gas-based DRI plant with HBI capabilities either onsite or near operations or offshore where there are sufficient supplies of reasonably priced natural gas.

For most BF producers, merchant HBI plants are the most obvious sources of supply. Merchant HBI allows those who do not wish to own and operate their own plant to purchase material in the open market. To date, blast furnace operators have chosen to obtain HBI in this manner. HBI plants dedicated to merchant supply exist in Venezuela, Libya, Russia and Malaysia. With the exception of Russian HBI supply, in recent years political and economic issues have limited the activities of several of these HBI suppliers.

Although DRI plants equipped with briquetting machines have the capability of producing HBI, their first priority is to supply hot DRI (HDRI) to their own steel operations. Therefore, BF operators would be subject to the uncertainty of the spot market.

To have greater control of HBI supply, without having to rely on merchant sources would require building a dedicated facility, as many EAF steelmakers have historically done. In regions where natural gas is not readily available or sufficiently allocated for HBI production, offshore sourcing may be a practical option.

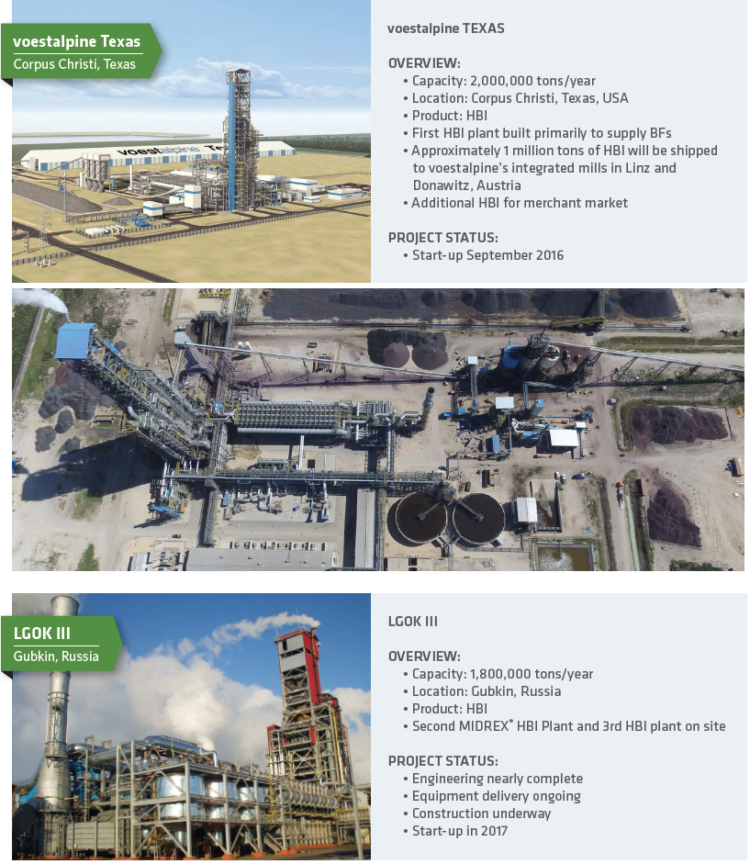

One steel company has already chosen this route. This year voestalpine of Austria began operations at its new 2 million metric tons per year MIDREX® HBI plant near Corpus Christi, Texas, USA. The company is capitalizing on the low natural gas prices in North America to supply its BFs in Linz and Donawitz, Austria. Current plans are for about half of the plant’s output to be supplied to voestalpine’s steel plants, with the remaining HBI to be sold to parties interested in supply over the long-term.

When Wolfgang Eder, CEO and Chairman of the Management Board of the voestalpine Group, announced the decision to invest in the HBI plant in Texas (Figure 3), he pointed out that the use of a natural gas-based reduction process will significantly improve the overall carbon footprint of voestalpine and serve as an important step in achieving the Group’s ambitious internal energy efficiency and climate protection objectives.

Europe is the first to pursue the offshore HBI sourcing solution, but it will not be the last. BF producers in India and China, who are faced with limited or high cost natural gas, much like in Europe, have an even greater incentive to search for ways to decrease smog derived from the burning of coal.

FIGURE 3.

View of voestalpine Texas LLC HBI plant site near Corpus Christi, Texas, USA.

HBI DEMAND FORECAST

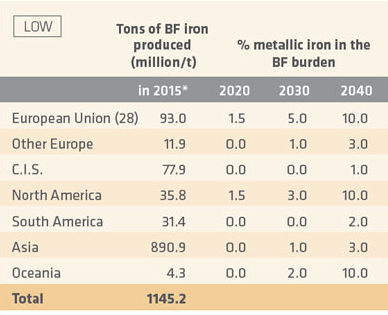

What is the potential for BF operators to use HBI in their furnace charge and how much tonnage would it represent? We have attempted to forecast the percentage of metallic iron (HBI) in the BF charge looking out to 2020, 2030 and 2040 and to equate the percentages to how many tons of HBI would be required. In each scenario we used the World Steel Association’s statistics for tons of BF iron produced in 2015 as the basis.

The first scenario, shown in TABLE I, is a conservative forecast, with HBI being used in the BF only in the European Union (EU) and North America in 2020, and there only as 1.5% of the BF burden. HBI usage would expand to all regions except the C.I.S. and South America by 2030, and the percentage of use would increase significantly in the EU and North America. By 2040, BF operators throughout the world would be using HBI, with it making up 10% of the BF charge in the EU, North America and Oceania. Although the percentage is modest in Asia (3%), the tonnage is impressive (26.73 million), primarily due to China. This is a projected major share of the world – 41.8 million tons.

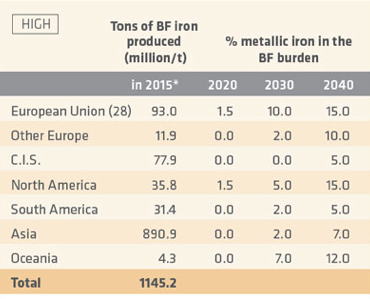

The second scenario (TABLE II) is an aggressive forecast, again showing HBI being used in the BF only in the European Union (EU) and North America in 2020. HBI usage would expand to all regions except the C.I.S. by 2030, with Oceania exceeded only by the EU in percentage of HBI used in the BF. By 2040, HBI use would have spread to all regions of the world. BF operators in North America and the EU would be using HBI as 15% of their charge with Oceania close behind at 12%. However, Asia would dwarf all other regions in forecasted tonnage used (62.36 million), primarily due to China; in this scenario world tonnage is projected at 88.9 million tons.

TABLE I.

Conservative forecast of potential HBI use in the BF (2020 - 2040) *source: World Steel Association

TABLE II.

Aggressive forecast of potential HBI use in the BF (2020 - 2040) *source: World Steel Association

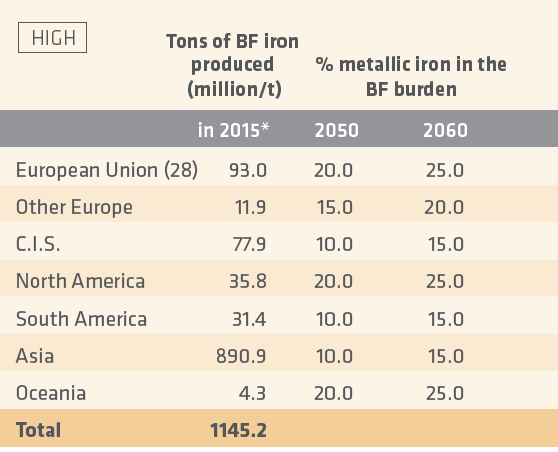

TABLE III. Aggressive forecast of HBI use in the BF (2050 – 2060) *source: World Steel Association

If we continue the trend lines out to 2050 and 2060 (TABLE III), integrated steelmakers in the EU, North America and Oceania could be using HBI as ¼ of the BF burden by 2060, with all other regions at 15-20%. The tonnage that represents is staggering – 185.7 million, with Asia accounting for 133.64 million of the total.

The logical question is, “How much HBI capacity exists?” And, even more important is, “How much HBI is currently produced?”

COMMISSIONED HBI CAPACITY VS. PRODUCTION

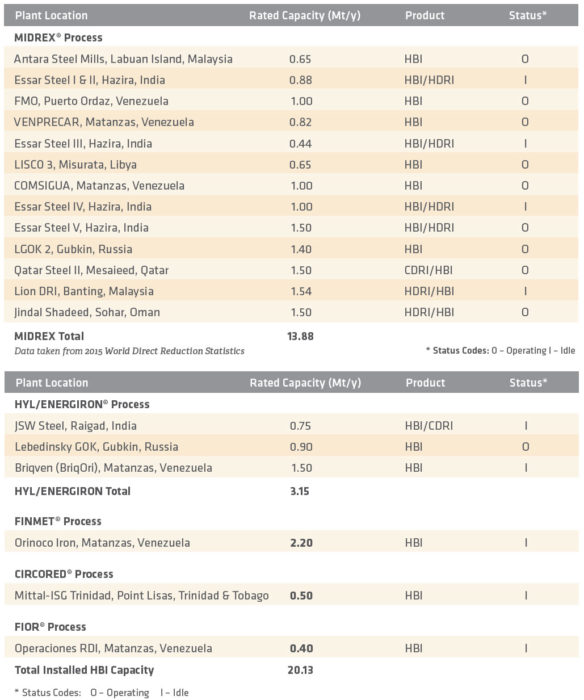

There are over 20 million tons of HBI capacity installed or under construction worldwide; 13 using MIDREX® technology, 3 HYL/ENERGIRON® and one each FINMET®, CIRCORED® and FIOR®. However, much of that capacity is not available as merchant HBI, either because of owner decision (in the case of dual product plants) or operational issues (natural gas price/availability, oxide pellet shortage, etc.) that limit some or all of production (TABLE IV).

TABLE IV.

Installed HBI capacity by process (operating and inactive) *Data taken from 2015 World Direct Reduction Statistics

In order to make a more accurate accounting of available HBI merchant capacity, we have to start by subtracting the dedicated HBI plants (i.e., whose sole product is HBI) that were idle in 2014: Briqven (BriqOri), Orinoco Iron, Circored and FIOR, which represent 4.6 million of installed capacity. Other currently installed HBI capacity has been impacted in various ways:

- Essar Steel made the decision to switch entirely to HDRI production (3.82 million tons) before they were idled due to natural gas price/availability.

- Qatar Steel has increased internal usage of CDRI (1.5 million tons) and no longer makes HBI.

- JSW Steel (0.75 million tons) has been idled due to natural gas price/availability.

- HDRI has become the primary product for Jindal Shadeed (1.5 million tons)

HBI plants in Venezuela (FMO, COMSIGUA and VENPRECAR), with a total installed capacity of 2.82 are severely limited due to a shortage of iron oxide pellets. - Lion DRI (1.54 million tons) is now closed

- LISCO 3 (0.65 million tons) is still recovering from the civil war in Libya.

- Chinese steel exports have so lowered the value of iron and steel products in their natural market region, that Antara Steel (0.65 million tons) has been forced to limit production.

So arguably that leaves the world with approximately 4.3 million tons of reliable merchant HBI capacity (LGOK & voestalpine Texas). Another 1.8 million tons is scheduled to come on line in 2017 with startup of LGOK III.

CONCLUSION

Sustainability is ultimately the key issue for every steelmaker going into the future. DRI products, which until recently have been viewed by integrated steelmakers as an EAF-specific charge material, may actually present a long-term, scalable solution going forward. The use of Hot Briquetted Iron (HBI) as a charge material in the blast furnace is now being seen as an effective way to help displace CO2 emissions while increasing hot metal production of the BF.

Investing in natural gas-based direct reduction plants, either directly or through long-term supply contracts, in strategically located sites around the globe is no longer a hypothetical scenario, as the first direct reduction plant built specifically to supply HBI to blast furnaces in Austria has begun operations on the Gulf Coast of Texas in the US. The voestalpine Texas plant is opening a promising new market for HBI.

The BF market shows tremendous potential for merchant HBI sales. However, the amount of HBI available to the merchant market is extremely limited. In order to meet even the conservative estimate of potential future demand, additional HBI plants need to be built. Midrex has been the leading supplier of HBI technology since the early 1980s and new MIDREX® HBI plants are on the way; however, more capacity will be needed to meet future projected demand.