DR-Grade Iron Ore Pellets – A Supply Overview

EDITOR'S NOTE: This article is based on presentations made by Chris Barrington at the MIDREX® Plant Operations Seminar, Paris, France, September 2017, and Metal Bulletin DRI & Pellets Conference, Dubai, UAE, April 2018. All mentions of tons are metric.

Iron ore is one of the two essential inputs for producing direct reduced iron (DRI); the other being natural gas or another hydrocarbon fuel that can be reformed to create a reducing gas rich in CO and H2. Although direct reduction processes can operate with pellets having an iron content of 65% or lower, typical of blast furnace (BF)-grade pellets, the preferred feed for a DR plant has an iron content of 67% or greater.

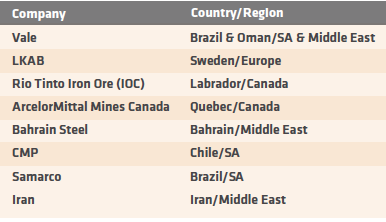

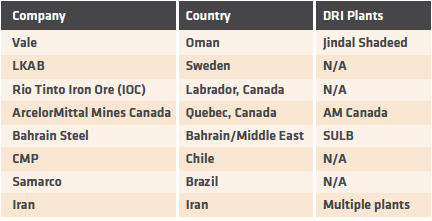

The principal sources of DR-grade pellets are located in South America, Canada, Sweden, Bahrain and Iran (TABLE I).

TABLE I.

Merchant DR-Grade Pellet Suppliers

Other sources of DR-grade pellets include:

- Metalloinvest (Russia)*

- Severstal Resources (Russia)

- FMO (Venezuela)* • Cleveland-Cliffs, Inc. – Northshore Mining (USA)* • India (48% from 5 producers) *

- Projected projects:

– Chippewa Capital Partners (MN, USA)

– New Millenium Iron (Canada)

– El Aouj Mining (Mauritania)

– Wadi Sawawin [Saudi Arabia)

* Supplies DRI plant(s) in home country

IRON ORE MARKET DYNAMICS

Elevated levels of Chinese steel production propped up the global demand for iron ore in 2016, since China accounts for close to two-thirds of the global seaborne iron ore trade. Global iron ore production grew 5% year-on-year in 2016, to a total of 2,106 million tons. Lump ore production increased 26 million tons to make up 15% of global production. Concentrate output was broadly flat, accounting for 25% of world production.

Iron ore production data for 2017 are not yet available but are thought to be not significantly different to those of 2016. Iron ore exports exceeded 1,500 million tons in 2016, and the seaborne market was more-or-less balanced for 62% Fe material. The tightness in the 62% Fe market, compounded by other pricing factors and financial speculation, contributed to considerable price volatility.

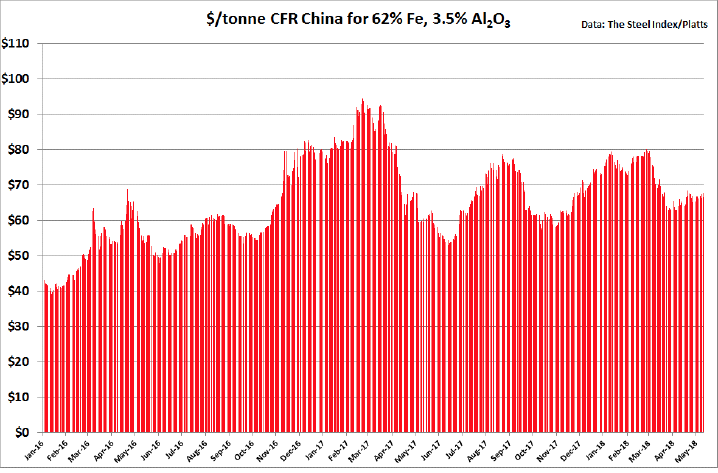

Iron ore prices improved markedly in the second half of 2016, having reached a low in mid-January when 62% Fe prices fell below $40/ton CFR China for only the second time since the inception of the S&P Global Platts’ index in 2008 (the other instance was in December 2015). Prices reached a peak of $84/ton in early December 2016, averaging $58/ton for the year, and kept climbing to over $90/ton in March-April 2017 before dropping back to just under the 2016 average in late June. A late summer rally allowed prices to rebound to just under $80/ton in September 2017 before retreating to winter lows just under $60/ton. However, restocking in February and March 2018 saw prices again pushing $80/ton, then falling back in late spring to around $65/ton.

Figure 1 shows an interesting trend developing since June 2017, in that that price valley are more shallow and the peaks a little higher with each succeeding cycle.

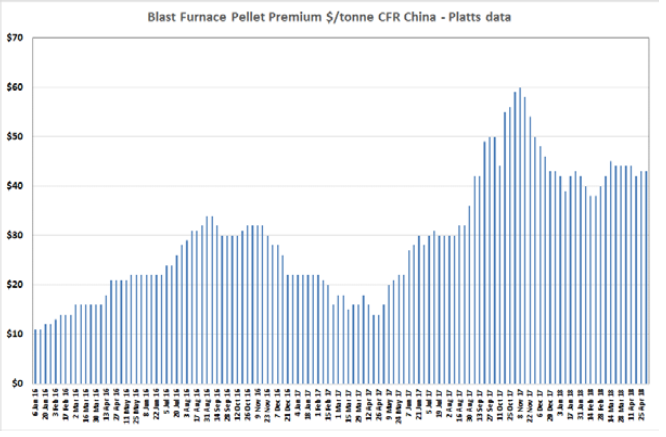

The BF pellet premium over sinter feed (CFR China) ranged from a little over $10/ton in January-February 2016 to about $35/ton in August 2016 and went on a rampage beginning in May 2017, spiking to about $60/ton in November 2017 (Figure 2). Although the premium retreated from the highwater mark, it only fell to $38-45/ton in spring 2018.

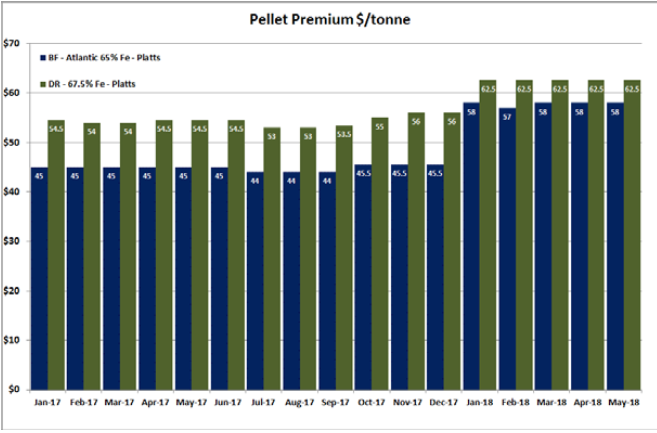

The premium for DR-grade pellets in the Atlantic Market hovered between $9-12/ton from January-December 2017, with 65% Fe prices hovering around d $45/ton (Figure 3). The new year saw the price of BF-grade pellets (65% Fe) jump to $58/ton; however the DR-grade premium only increased by $5-6/ton.

FIGURE 1.

Iron ore prices CFR China

FIGURE 2.

Blast furnace pellet premium CFR China

FIGURE 3.

DR-grade pellet prices (Atlantic Market)

OUTLOOK FOR DR-GRADE PELLETS

TABLE II. DRI plants in countries where DR-grade pellets are produced

As we saw in TABLE I, DR-grade pellets primarily are produced in four regions of the world: North and South America, Europe and the Middle East (including Iran). However, the presence of DRI plants limits the availability of pellets for merchant trade outside the countries or regions where they are produced (TABLE II).

Brazil – Vale & Samarco

Vale’s operational iron ore pellet capacity is about 41 million tons in Brazil and slightly more than 9 million tons in Oman. Most of its Brazilian capacity is focused on BF-grade pellets while the Oman operation is devoted to DR-grade pellet production, which totaled 9.2 million tons in 2017. Through 1Q2018 2.2 million tons have been produced by the Oman plant.

Vale plans to increase overall pellet production capacity by more than 12 million tons in 2018. Tubarão 2 was restarted in January 2018 and Tubarão 1 was scheduled to start in April 2018. The two Tubarão lines have a combined capacity of approximately 5 million tons. The São Luis plant is scheduled for restart in 3Q2018, which will add 7 million tons of capacity, mostly BF pellets.

With Samarco still recovering from the tailings dam rupture in November 2015, Vale made almost all Brazilian iron ore shipments in 2017. Sales of DR-grade pellets exceeded 12 million tons and accounted for ± 41% of total pellet sales, which is expected to increase in 2018.

A breakdown of DR-grade pellet exports by Vale in 2017 is shown in Figure 4 (Note: USA total might include some BF pellets; Argentina total excludes 0.7 million tons of BF pellets).

Samarco historically has been the Brazilian iron ore producer most closely identified with DR-grade pellets. Production totaled 24 million tons in 2014 and 24.6 million tons in 2015. The Ponta do Ubu facility has four pelletizing lines with a total annual capacity of 30.5 million tons. However, there was no production in 2016 and 2017 and only a few sales from stock that was not eliminated by the late 2015 flooding.

There are many issues involved in Samarco resuming pellet production including government approvals and granting of environmental and water supply permits and licenses by state authorities, restructuring company debt, economic viability, access to need infrastructure (owned by Vale), local and national public opinion and what to do with the tailings.

LKAB

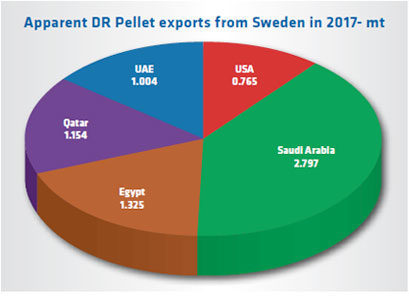

Total iron ore pellet production and sales by the Swedish company were 24.6 and 22.9 million tons, respectively, in 2017. This compares with 2016 production and sales of 24.0 and 22.7 million tons, respectively. The Kiruna operation delivered 14.4 million tons and the Malmberget/Svapavaara plants accounted for 8.4 million tons of 2017 sales. Blast furnace pellets made up 55% of sales value and DR pellets accounted for 26%. According to iron ore trade statistics, Sweden exported about 7 million tons of DR pellets in 2017, compared with 6.5 million tons in 2016. The breakdown of exports by country in 2017 is shown in Figure 5. The installed pellet capacity of LKAB is about 28 million t/y, with three lines at Kiruna (BF and DR pellets), two at Malmberget (BF pellets) and one at Svappavaara (BF pellets). However, due to environmental permits, effective capacity is limited to 26 million t/y. Kiruna has a combined capacity of more than 10 million tons and has the flexibility to manage production of BF and DR pellets in response to market conditions. LKAB uses two lines for DR-grade pellets, KK3 and KK4, which are equipped to coat the pellets using organic binders. DR-pellet capacity could be increased by adding coating capability on the KK2 line.

CANADA – RIO TINTO IRON ORE (IOC) AND ARCELORMITTAL MINES CANADA

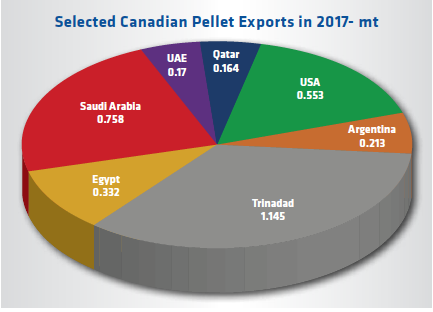

The two producers of DR pellets in Canada have a combined capacity of approximately 22.7 million tons – ±12.5 at IOC and 10.2 at ArcelorMittal. IOC produced 10.5 million tons in 2017, an increase of more than 10% over 2016. IOC’s share of DR-grade pellet sales was ±31% in 2017, which exceeded expectations. Prior to a workers’ strike in March, 2018 production was forecasted to be 12-12.5 million tons (each month of lost production equates to approximately 1 million tons).

ArcelorMittal Mines Canada produced 10.1 million tons of DR-grade pellets in 2017, most of which was used in ArcelorMittal’s Canadian DRI plants, as well as its DRI plant in Hamburg, Germany. Tagora Mines reportedly has acquired the assets of the former Wabush Mines Scully mine and Pointe Noire pellet plant and intends to restart operations. However, they are unlikely to produce DR-grade pellets.

Canadian exports in 2017 are estimated by the author as 3.3 million tons, excluding 0.9 million tons shipped by ArcelorMittal Mines to the company’s Hamburg steel mill. A breakdown by country of DR-grade pellet exports from Canada in 2017 is shown in Figure 6.

FIGURE 5.

Swedish DR-grade pellet exports by country (Data sources: LKAB and trade statistics)

FIGURE 6.

Canadian DR-grade pellet exports by country (Data sources: trade statistics)

IRAN

Pelletizing capacity in Iran continues to grow. It currently stands at 31 million t/y and is planned to exceed 40 million t/y by first quarter 2018. Pellet production in 2016 was 23.3 million tons.

With DRI production in Iran reaching 16.1 million tons in 2016, pellet demand can be estimated at about 23 million tons. (Editor’s note: Iran produced 20.6 million tons of DRI in 2017) Therefore, domestic demand, more than covers the entire supply of DR-grade pellets, leaving limited prospect of merchant sales.

CONCLUSION

The supply of DR-grade iron ore pellets always has been tight, but it could become more of a problem with the prolonged disruption of production at Samarco, the addition of HBI capacity to meet growing demand, and the economics of DR-grade pellet production. Some companies building direct reduction plants, such as Cleveland-Cliffs Inc, which has announced plans for a 1.6 million t/y HBI plant using MIDREX® Technology, have their own iron ore resources. Others are considering blending BF and DR-grade pellets or even having a new pellet designed.

One thing is certain, the creativity of DR plant operators, the ingenuity of process suppliers, and the expertise of iron ore pellet producers will find a way to assure that the supply of DRI products keeps pace with the demand.